In this article you will find:

A clear challenge in portfolio management is requesting payment in a friendly manner through collection messages, thereby encouraging customers to ultimately fulfill their financial obligations to the company.

This pressure, uncomfortable yet necessary for any business, can entail complex communication for both the sender and the recipient.

However, it's possible to ease this interaction, making it smoother without sacrificing solidity. Of course, this requires choosing the right words, the most favorable medium, and the opportune moment. In the following paragraphs, I'll show you how the right message, delivered through a high-reach channel like WhatsApp, can spare you the hassle of collection and improve the outcomes of your collection strategy.

But before delving into details, let's explore how segmentation sets the perfect stage for ensuring the effectiveness of any notification.

Divide your portfolio and prioritize accounts receivable.

To strategically collect payments, we need tactics, and one of the most foolproof is segmentation. This process involves breaking down the debtor base into smaller groups based on different criteria to drive payment under similar characteristics.

4 key attributes for segmentation:

- Debt amount

- Debt age

- Debtor type

- Product or service

Advantages of segmentation:

- Optimizing time and focusing team efforts;

- Scaling or prioritizing urgent cases;

- Better understanding of each customer during collection;

- Offering tailored solutions that meet the debtor's needs.

Why WhatsApp?

It's the most widely used instant messaging platform in Latin America, with proven effectiveness: 80% of messages are opened within the first five minutes of being sent.

In other words, this channel ensures contactability, one of the main indicators - and at the same time obstacles - encountered by collection departments.

From segmentation to the personalization of messages

In conclusion, profiling the portfolio and contacting the client through the appropriate medium allows a more personalized approach in the communications with the debtor. Understanding the client's financial status and using a familiar channel will build trust, increase cooperation, and open the doors to a successful reconciliation.

The most effective debt collection messages to persuade and obtain payment via WhatsApp

Break down payment barriers, depending on the case presented. Pay attention to these examples and draft your messages to address objections.

Based on the most common responses

Address these excuses or ways of delaying payment.

|

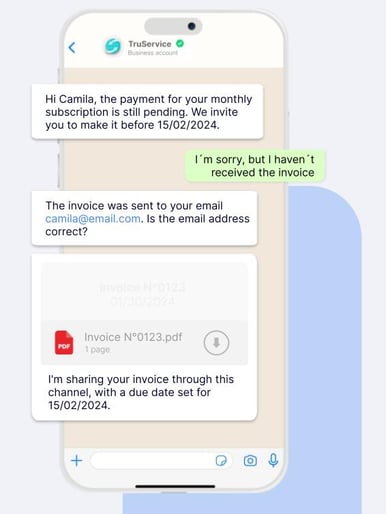

Reason: “I´m sorry, but I haven´t received the bill” Solution: In this case, confirm the contact details with the client again. Then, verify if indeed the invoice was not sent/received. While you continue the conversation, send the invoice in the same chat |

|

.jpg?width=386&height=514&name=MockUps_Collection%20(1).jpg)

|

Reason: “I still have time, the due date is still far away” Solution: Apply a reminder close to the deadline. |

|

Reason: “I've already made the payment, although it seems it hasn't been registered yet.” Solution: It is a possible situation, so if you receive this response, the important thing is to verify in the system and proceed to request the respective proof of payment. |

.jpg?width=386&height=514&name=MockUps_Collection%20(2).jpg)

|

|

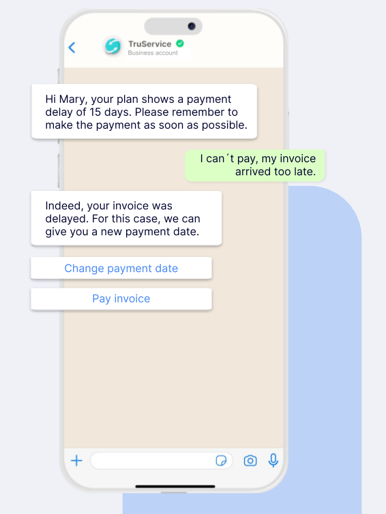

Reason: “My bill arrived too late” Solution: In this case, negotiate a new deadline and ensure the client commits to completing it before the due date. Set up an early reminder. |

Based on the types of debtors

Discover how to approach these types of clients.

|

Casual client They're behind on payment for some reason and don't have the ability to pay by the deadline. Solution: Offer an agreement to reconcile their debt. |

.jpg?width=386&height=514&name=MockUps_Collection%20(4).jpg)

|

.png?width=386&height=514&name=MockUps_Collection%20(2).png)

|

Intentional client They are fully aware of their debt but have no intention of paying it. Solution: Insist on the consequences of this inappropriate behavior. |

Based on the age of the debt

Issue notices that encourage payment after the invoice due date.

|

Short term During the first 30 days. Solution: Remind the payment and invite them to make it as soon as possible. |

.png?width=386&height=514&name=MockUps_Collection%20(3).png)

|

.png?width=386&height=514&name=MockUps_Collection%20(4).png)

|

Medium term Between 60 and 90 days Solution: Suggest solutions to settle the overdue account. |

|

Long term More than 90 days. Solution: Strongly reinforce the implications of not addressing their debt. |

.png?width=386&height=514&name=MockUps_Collection%20(5).png)

|

Simplify your collections and recover your overdue portfolio

Integrate chatbots with WhatsApp using Truora

- Achieve effective contact with your clients;

- Automate reminders;

- Send personalized messages;

- Improve your clients' collection experience;

- Free your team from operational tasks.